do nonprofits pay taxes on rental income

And yes the expenses are deducted as a miscellaneous expense. The IRS link below states that you can deduct not-for-profit rental expenses up to the amount of rental income.

Taxable Activities Of Nonprofits A Basic Guide To Ubit Wegner Cpas

Additionally nonprofits and churches are exempt from paying all property taxes.

. Tax-exempt organizations also known as 501 c 3 organizations can have Unrelated Business Taxable Income UBTI when the organization has revenue streams outside of its direct charitable purpose. That said youll want to check your local rules in case they differ from federal ones. Generally speaking rents from real property are excluded from UBTI.

You use Form 990-T for your tax return. Dividends interest rents annuities and other investment income generally are excluded when calculating UBIT. Which Taxes Might a Nonprofit Pay.

Below well detail two scenarios in which nonprofits pay tax. For example if your nonprofit earns any income from activities unrelated to its purpose it will owe income taxes on that amount. Tips on Rental Real Estate Income Deductions and Recordkeeping.

While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes. The rental income you declare on your income taxes will depend on your method of accounting. This means the rental income investment income and many other forms of income that would be tax exempt for other organizations are not tax exempt for 501c7 9 and 17 organizations unless the income is derived from activities substantially related to the exempt purpose.

Published on September 4 2014. One source of UBI is rental income. The only income the nonprofit would derive is the rental income with no share or participation in the for-profits activities.

But determining what are an organizations exempt purposes is not always as clear as one might think and distinguishing between related and unrelated activities can be tricky. For the most part nonprofits are exempt from most individual and corporate taxes. There are certain circumstances however they may need to make payments.

You cannot deduct a loss or carry forward to the next year any rental expenses that are more than your rental income for the year. If you are a cash basis taxpayer you report rental. The not for profit rental income was entered on line 21 of 1040.

However not all rental income is subject to unrelated business income. Nonprofits are also exempt from paying sales tax and property tax. All rental income must be reported on your tax return and in general the associated expenses can be deducted from your rental income.

However there are two exceptions where this type of income is taxable. Rental income by itself should not jeopardize your organizations federal 501 c 3 charity status. If the nonprofit uses the property for an unrelated business it pays tax as described in Form 598.

A charity may have rental income and so long as the property is not subject to a mortgage and the owner is not providing significant personal. While the income of a nonprofit organization may not be subject to federal taxes nonprofit organizations do pay employee taxes. Most individuals use the cash basis method Most individuals use the cash basis method This method requires you to report income as.

If you own rental real estate you should be aware of your federal tax responsibilities. Any nonprofit that hires employees will also. There are clear rules as well as several exceptions to.

A nonprofit that uses the property for a mix of related and unrelated purposes has to allocate gain from the sale between the two. Nonprofits and churches do not have to pay federal income tax nor do they have to pay any state or local income tax. Any gain allocated to the unrelated business purpose is taxable.

Rental Income and UBTI A Look at the IRS Guidance to Its Auditors. While nonprofits can usually earn unrelated business income without jeopardizing their nonprofit status they have to pay corporate income taxes on it under both state and federal corporate tax rules. The IRS defines unrelated business income UBI as income from a trade or business regularly carried on by a nonprofit organization that is not substantially related to the performance by the organization of its exempt function.

By not collecting these taxes more funds are able to be deployed toward the. Generally the first 1000 of unrelated income is not taxed but the remainder is Lets go back to the Friends of the Library nonprofit.

Unrelated Business Income Tax Ubit For 501c3 Nonprofits

2020 Guidelines For A Nonprofit Reimbursement Policy

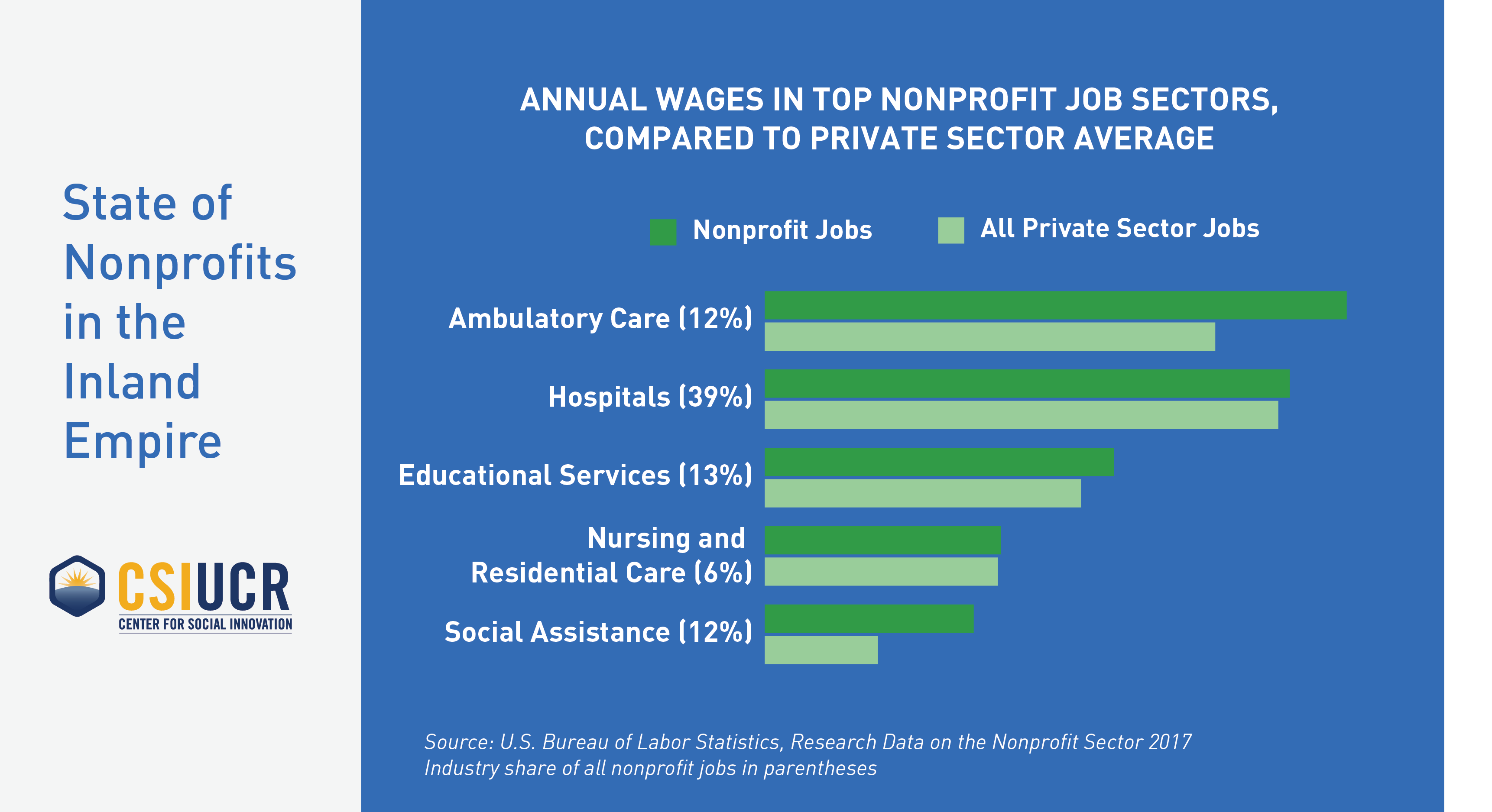

State Of Nonprofits In The Inland Empire Center For Social Innovation

Misuse Of Funds Nonprofit Help Fraudulent Misappropriation Charity Fundraising Nonprofit Fundraising Non Profit

Tax Information Nonprofits Renting Extra Space Church Facility Solutions

12 Tips For Growing Your Nonprofit Email List Nonprofit Emails Nonprofit Email Marketing Infographic Marketing

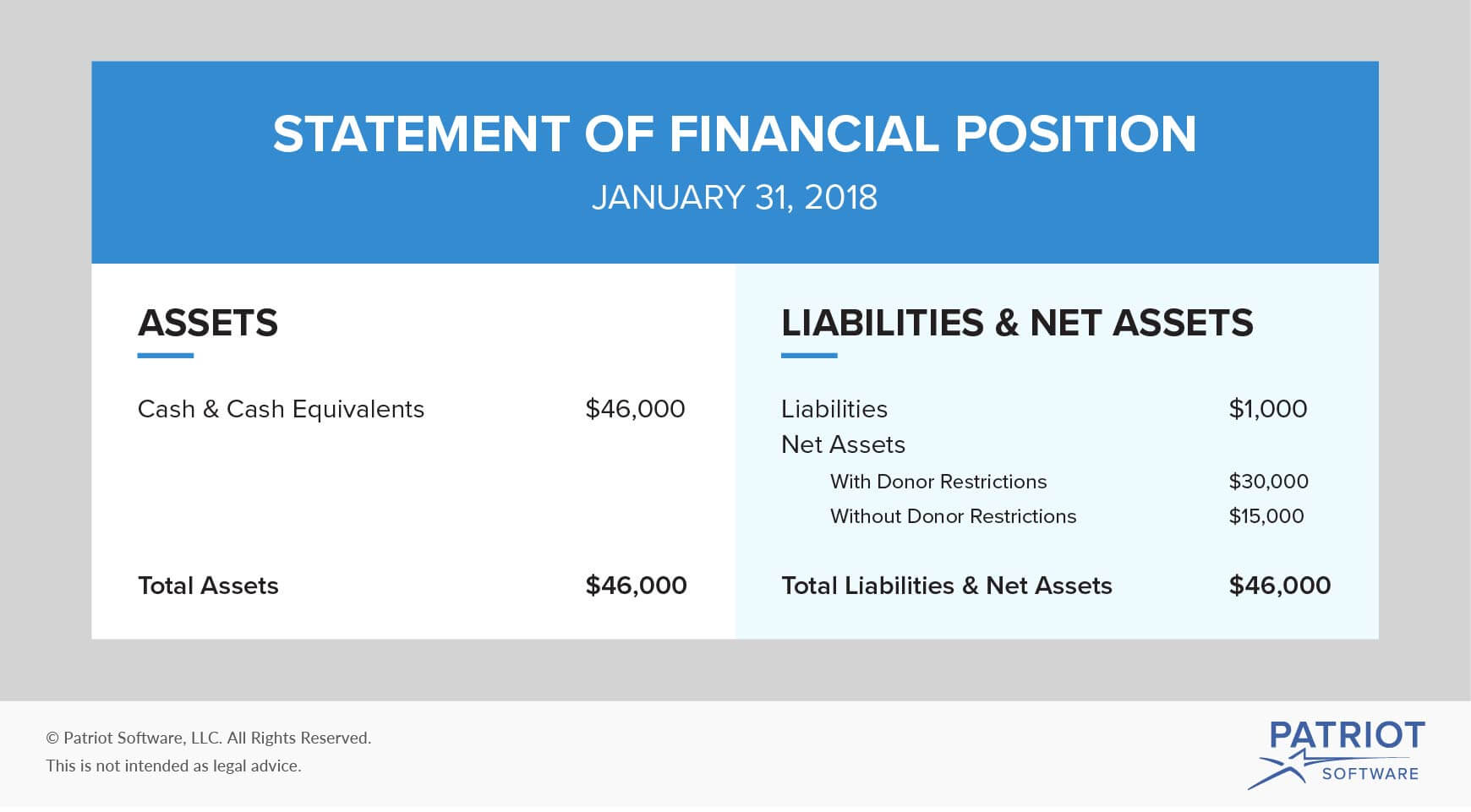

Accounting For Nonprofit Organizations Financial Statements Beyond

Ubit Issues For Shared Spaces Nonprofit Law Blog

List Growth Campaign Pricing For Nonprofits Care2 Campaign Non Profit Graphing

A Guide To Tax Filing Requirements For Nonprofit Organizations

Nonprofit Statement Of Activities Report Net Asset Changes

Florida Property Appraisers Consider Troubling Position On Property Tax Exemption For Nonprofits Based On Recent Court Decision Batts Morrison Wales Lee P A A Non Profit Cpa Batts Morrison Wales

Pdf Run Profit And Loss Statement Profit And Loss Statement Statement Template Profit

Documents Needed To Apply For A Texas Id Or Texas Drivers License How To Apply Houston Community Texas

Reporting Nonprofit Operating Expenses Nolo

7 Leasing Tips For Nonprofits The Nonprofit Centers Network

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics